Homeowners Insurance in and around Mahomet

Looking for homeowners insurance in Mahomet?

Help cover your home

Would you like to create a personalized homeowners quote?

- Illinois

- Indiana

- Missouri

- Wisconsin

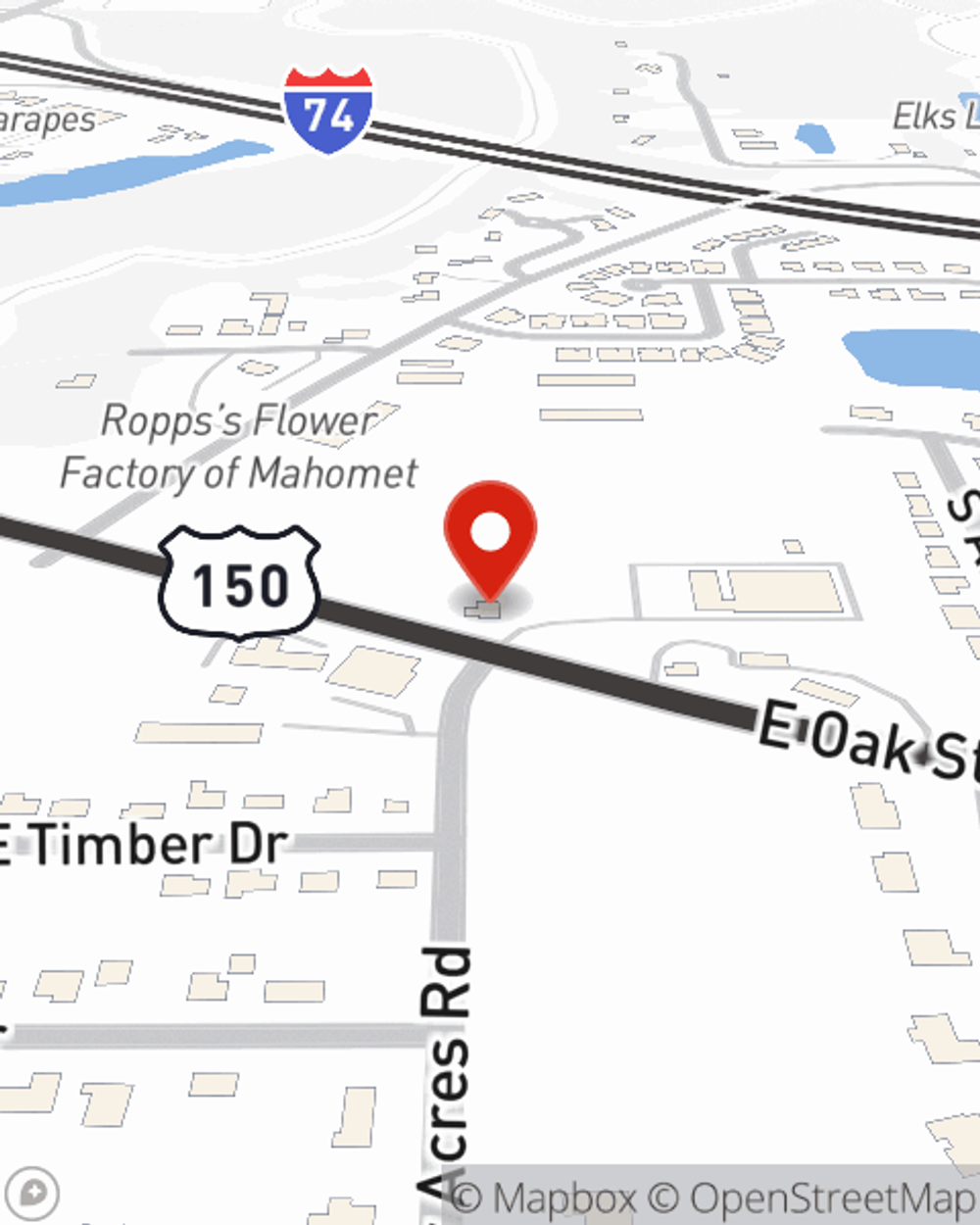

- Mahomet, IL

- Champaign, IL

- Urbana, IL

- Farmer City, IL

- LeRoy, IL

- Mansfield, IL

- Normal, IL

- Decatur, IL

- Bloomington, IL

There’s No Place Like Home

Your home is a special place. You need homeowners coverage to keep it safe! You’ll get that with homeowners insurance from State Farm, a top provider of homeowners insurance. State Farm Agent Nicole Wellman is your wise authority who can offer coverage options aligned with your individual needs.

Looking for homeowners insurance in Mahomet?

Help cover your home

Don't Sweat The Small Stuff, We've Got You Covered.

Your home is the cornerstone for the life you treasure. That’s why you need State Farm homeowners insurance, just in case the unexpected happens. Agent Nicole Wellman can roll out the welcome mat to help set you up with a plan for your particular situation. You’ll feel right at home with Agent Nicole Wellman, with a hassle-free experience to get high-quality coverage for your homeowner insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Home can be a sweet place to live with State Farm homeowners insurance.

Don’t let the unexpected about your home keep you up at night! Get in touch with State Farm Agent Nicole Wellman today and discover how you can save with State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Nicole at (217) 328-3300 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Nicole Wellman

State Farm® Insurance AgentSimple Insights®

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.